Xiaomi 14 Ultra Camera Details Leak, Set to Continue Xiaomi 13 Ultra Legacy

unitednewsbag Jan 31, 2024 0 35

Nothing Phone 2a Secures TUV Certification with Charging Specs Revealed Before Launch: Latest Updates

unitednewsbag Jan 31, 2024 0 28

Ola Electric Founder’s AI Venture, Krutrim, Achieves Unicorn Status as India’s First Billion-Dollar AI Startup

unitednewsbag Jan 31, 2024 0 30

Tecno Spark 20: Key Specifications and Pricing Teased Ahead of India Launch

unitednewsbag Jan 31, 2024 0 39

Honor X9b Spotted Online Ahead of Anticipated India Launch; Key Specifications Revealed

unitednewsbag Jan 31, 2024 0 37

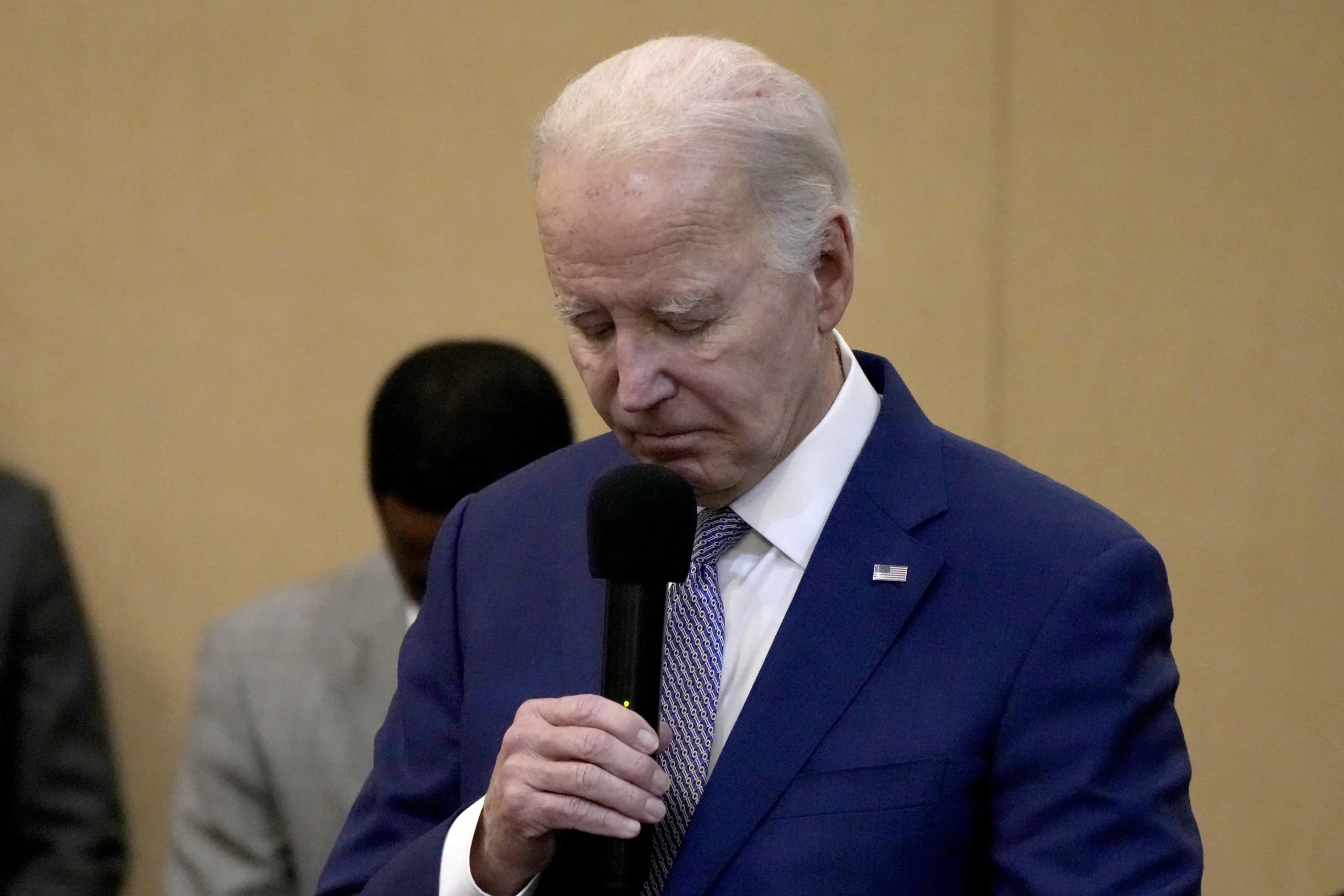

Republicans Seek Black Voter Support, Prompting Biden Campaign Mobilization

unitednewsbag Jan 31, 2024 0 39

Biden Commends Black Churches, Highlights Their Impact on Faith and Unity

unitednewsbag Jan 31, 2024 0 34

Republican-Led States Employ Tactics to Keep Abortion Off the Ballot

unitednewsbag Jan 31, 2024 0 42

House Republicans Unveil Impeachment Articles in Bid to Remove Homeland Security’s Mayorkas Over Border Issues

unitednewsbag Jan 31, 2024 0 30

Biden Vows U.S. Response Following Iran-Backed Drone Strike that Kills 3 American Troops in Jordan

unitednewsbag Jan 31, 2024 0 35

Jackson State University Welcomes First Female Kicker in NCAA Division I at an HBCU

unitednewsbag Jan 31, 2024 0 32

Kim Ng, MLB’s Pioneer Female General Manager, Parts Ways with Miami Marlins for the Upcoming Season

unitednewsbag Jan 31, 2024 0 35

Former MLB Pitcher Arrested in Connection with 2021 Murder of Father-in-law, Authorities Report

unitednewsbag Jan 31, 2024 0 77

Texas Rangers Dominate Houston Astros in Game 7, Clinch World Series Berth

unitednewsbag Jan 31, 2024 0 36

Arizona Diamondbacks Secure World Series Berth After Triumph Over Phillies in National League Championship

unitednewsbag Jan 31, 2024 0 30